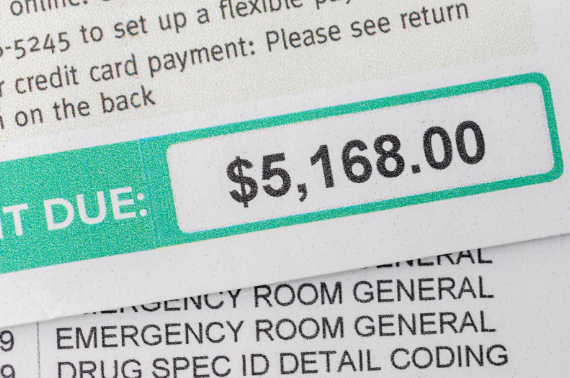

When you’re injured in a car crash or another incident caused by someone else’s negligence, medical bills can quickly become overwhelming. Many clients are surprised to learn that hospitals, doctors, and even their own health insurance providers can place a legal claim against their personal injury settlement.

These claims—called liens or subrogation rights—can significantly reduce your net recovery if they aren’t handled correctly.

Here’s how insurance provider and hospital liens work under Texas law, what subrogation means, and how an experienced personal injury lawyer can protect your settlement.

RELATED: Recovering medical expenses in your Texas personal injury case

Understanding hospital and medical provider liens

A lien is essentially a legal claim on your settlement proceeds. In Texas, hospitals and certain providers are allowed to file liens to make sure they are paid for the care they provided after your accident. Hospital liens give care providers a legal interest in your case outcome and can delay you receiving your settlement until they are resolved.

The Texas hospital lien statute

Under Texas Property Code Chapter 55, a hospital that treats you within 72 hours of an accident may file a lien for the reasonable cost of your care.

The 72-hour requirement is important. It ensures that liens only cover urgent, accident-related care and not routine or unrelated medical treatment that might occur weeks later. The law is meant to balance the hospital’s right to payment with the patient’s right to fair compensation.

Only hospitals, EMS providers, and certain trauma doctors can file a lien. A physical therapy clinic or a primary care doctor who sees you later usually cannot.

The lien attaches only to your personal injury claim against the at-fault party and not to your wages, home, or unrelated legal claims. And importantly, the hospital may only claim a “reasonable and regular” charge for services. If the amount seems inflated—often much higher than what insurers or Medicare pay—your attorney can challenge its validity.

Common problems and legal challenges with liens

Many Texans are shocked when they see a lien for hundreds of thousands of dollars, even for short ER visits.

Hospitals often file liens for their full list price or “chargemaster” rates. These numbers can be three to five times higher than what health insurers typically pay for the same care. Sometimes providers file liens in the wrong county or after a case has already been settled, which can make the lien invalid. In other cases, hospitals include charges for care that has nothing to do with the accident. An experienced attorney will investigate these issues, dispute invalid portions of the lien, and use their legal resources to force a reduction when possible.

Health insurance subrogation: When your own insurer wants repayment

If your health insurance pays for some of your accident-related treatment, it may later seek repayment from your settlement. This process is known as subrogation or reimbursement. Essentially, your insurer is stepping into your shoes to collect back the money it spent because of someone else’s negligence.

Types of subrogation claims

The rules for health insurance subrogation vary based on the coverage type.

ERISA plans

Many employer-sponsored health plans are governed by ERISA, a federal law that often gives them stronger rights than Texas state law would allow.

ERISA plans may be entitled to full reimbursement, even if you are not fully compensated for your injuries. Fully insured health plans, on the other hand, may be subject to Texas’ “made whole” doctrine, which can limit repayment rights if your settlement does not cover all your losses.

Medicare and Medicaid

Government programs such as Medicare and Medicaid also have strict rights to reimbursement. They have special formulas for calculating repayment and require reporting of your claim. Failure to pay them back can result in penalties, interest, or even federal lawsuits. Tricare and VA benefits can also lead to liens, and those claims have their own federal rules.

Negotiating and reducing subrogation claims

The amount you must repay to the insurance company is not always final. Skilled attorneys can often negotiate significant reductions.

For example, under Texas law, most lienholders must reduce their claim proportionally to account for attorney’s fees and litigation costs. This helps ensure you aren’t left with nothing after paying your lawyer.

In hardship cases, Medicare, Medicaid, and some private plans may agree to a further reduction or even a full waiver. Your lawyer can present evidence of your ongoing medical needs, lost wages, and living expenses to strengthen the case for a reduction.

Examples of negotiating liens and subrogation

Imagine you are taken to a San Antonio hospital after a crash and the institution files a lien for $150,000. Your lawyer challenges the bill by comparing it to standard payment rates and negotiating with the provider, reducing the amount to $45,000. This single step could put over $100,000 more into your pocket.

In another example, a worker with an ERISA health plan suffers catastrophic injuries in an oilfield crash. The plan initially demands full repayment, but the attorney successfully argues for a “common fund” reduction to account for attorney’s fees, lowering the repayment by tens of thousands of dollars.

Why timing and legal help matter

Lien resolution is not a do-it-yourself project. Hospitals and insurers have legal departments and collection teams focused on recovering as much as they can. If you settle your case without properly addressing liens, you may still be legally obligated to pay them, which could wipe out your settlement later.

A personal injury lawyer will identify every lien, verify its validity, and challenge overreaching charges. Lawyers can negotiate reductions, coordinate with Medicare and Medicaid when necessary, and make sure you receive your share of the recovery as quickly as possible. The goal is to maximize your net recovery to meet your needs.

RELATED: Why net worth matters in personal injury cases

FAQs about Texas liens and subrogation

Can a hospital refuse to bill my health insurance and just file a lien?

Some hospitals try to avoid insurance billing to collect more money via a lien, but courts have ruled that this may violate Texas law. Your lawyer can pressure the hospital to submit bills through your insurance.

What happens if I ignore a lien?

Lienholders can sue you (or even your attorney) to collect. It’s safer to resolve liens before funds are disbursed.

Do I always have to repay Medicaid or Medicare?

Yes, but the repayment amount is usually reduced according to federal formulas, and hardship reductions are sometimes available.

Will I have anything left after liens are paid?

A good attorney will fight for reductions so you receive fair compensation. Texas law generally requires lienholders to share attorney’s fees, so you keep more of your settlement.

Crosley Law can help you navigate liens and repayments

At Crosley Law, we focus on maximizing your net recovery—not just your gross settlement. We dig into every hospital lien and insurance claim, challenge inflated bills, and negotiate aggressively to protect your financial future.

If you’re facing hospital bills, lien notices, or insurer reimbursement demands after a Texas accident, call Crosley Law at 210-529-3000 or fill out our contact form for a free consultation.

The information in this article is for educational purposes only and does not constitute legal advice. For personalized guidance, speak to a qualified attorney.