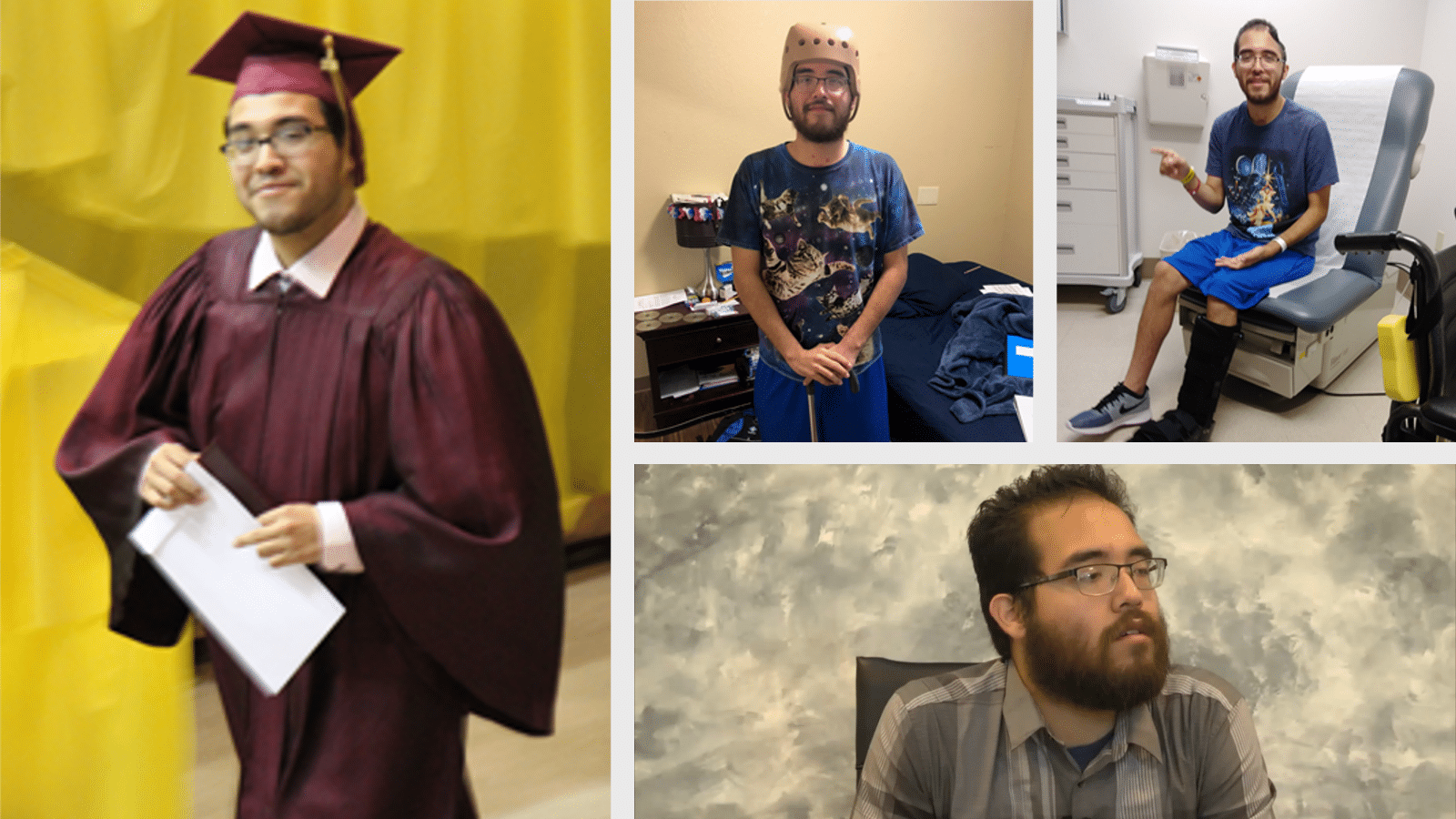

Joe was a hardworking laborer who was headed to a job. He entered an intersection when a young driver improperly made an unprotected left turn in front of his truck. During the collision, Joe suffered a back injury that required an intense course of physical therapy and chronic pain management

While the other driver, a 17-year-old girl, was clearly at fault, her insurance company took a hardline approach. They claimed Joe was at least 20% at fault for the collision, arguing that he had plenty of time to brake and avoid the wreck. Joe knew he needed help, and he turned to Crosley Law.

A Tough Venue, a Likeable Defendant, and Victim Blaming

The at-fault driver’s insurance company was taking a gamble. They assumed they had a few advantages in Joe’s case:

- Joe had a pre-existing back injury that had required spinal injections, and the insurer believed they could blame his current symptoms on the old injury.

- The at-fault driver was a very likable person, and the adjuster hoped a jury would give her the benefit of the doubt.

- Joe’s injury occurred in Comal County, a venue that has been historically unfavorable to accident victims — especially if they’re Spanish-speaking, like Joe.

To fight back, the attorneys at Crosley Law took an aggressive approach.

When the insurance company refused to issue a reasonable settlement offer, we filed a lawsuit and signaled that we were ready and willing to try Joe’s case. We carefully investigated Joe’s claims, calculated his damages, and put significant pressure on the insurance company. Our tactics worked, and we eventually negotiated a very favorable settlement with the negligent driver’s insurance company.

RELATED: What’s an Uninsured Motorist, and How Can I Protect Myself?

An Underinsured Motorist Settlement Adds to Joe’s Recovery

While settling with the young driver who caused Joe’s crash helped with some of the lost income and medical bills, it didn’t cover everything. Because we strive in every case to maximize our client’s monetary recovery, we looked for other sources of insurance coverage. Luckily, Joe was a responsible vehicle owner who had uninsured and underinsured motorist (UM/UIM) coverage. This coverage steps in and helps compensate a victim when the negligent party had insufficient insurance.

We quickly filed a UIM claim with Joe’s insurance company, Allstate, and we braced ourselves for a fight because Allstate is notorious for making low-ball settlement offers in UIM claims.

Nonetheless, we sent a settlement demand, asking for Joe’s policy limits. Surprisingly, Allstate paid Joe the entire insurance policy limits. While we don’t know the insurance company’s reasoning for a quick settlement, we believe that Crosley Law’s reputation played a significant role.

“In three recent trials against Allstate, we beat them every time,” says Tom Crosley. “And not just by a little bit. We beat them badly. The insurance adjuster knew that if they denied Joe’s claim, they would be facing a tough courtroom opponent.”

Joe was thrilled with these results. Between the two settlements, the insurance companies paid a total of $121,500.

Crosley Law: Fighting for Crash Victims Throughout Texas

The injury lawyers at Crosley Law are not afraid to stand up to insurance companies and take cases to trial, and we have a significant track record of success. If you have been injured or lost a loved one in a car wreck, call us today at 210-LAW-3000 | 210-529-3000 or fill out our easy-to-use contact form. We’ll set up your free consultation so you can get expert legal advice about your situation.

The content provided here is for informational purposes only and should not be construed as legal advice on any subject.