A particular kind of sinking feeling sets in when you realize your vehicle is totaled. In the immediate aftermath of a car accident, everyone’s primary concerns should be looking out for the safety of those involved, calling the police, and getting prompt medical attention — even if any injuries resulting from the crash seem minor.

Once the dust settles, however, the reality that you’re without a vehicle or with limited means of transportation will sink in. On top of your injuries, you’ll now have to deal with the process of getting your vehicle assessed by your insurance company and figuring out what to do next.

If your car has been totaled in a wreck and you’ve been hurt, one of the first things you should do after receiving medical attention is contact a qualified and experienced attorney who can sit down with you for a free consultation and listen to the details of your story. A personal injury attorney can provide you with candid advice about your best course of action and whether or not you have grounds for filing a lawsuit. From there, your attorney can handle most, if not all, of the details related to your case, including sorting out what you can do about your totaled vehicle.

Below, we’ve provided an overview of how insurance works after your car has been totaled in a crash so you can better understand the process, what your rights are, and what you can do to minimize your losses after your vehicle has been wrecked.

What Does “Totaled” Really Mean?

Depending on the circumstances, you may get a call from your insurance company after a car accident, or you may have to call them to make a claim and have your car’s value and the cost of repairs assessed.

When your car has been “totaled,” it means, in technical terms, that it is considered a “total loss.” Different states, insurance companies, and even individual policies have differing definitions of a total loss, but it often involves one or more of the following situations:

- The cost of repairing the vehicle will exceed a certain percentage of its value (usually between 50% and 80%)

- Repairs of the vehicle cannot be made safely

- Repairs cannot return your car to a state where it meets minimum legal safety requirements

While these conditions may seem straightforward, there can be a wide variety of complications. Some states set exceptions to the established rules for vehicles of a certain age. Some narrowly define the “total loss threshold” (TLT) of repair costs compared to the car’s value for a vehicle to be considered totaled (like Texas, where the threshold is set at 100%), while others do not. Furthermore, the decision about whether a car is a total loss is often based on its “actual cash value” (ACV), which can be calculated in different ways.

Who Has the Most to Lose From a Totaled Car?

When deciding whether to write off a car as totaled, the one thing that is nearly always left out of the equation is you. Insurance companies don’t care how you feel about your car, whether you still haven’t paid off your car loan, or if it is your only vehicle. They just want to find a way to minimize their losses on the claim you’re making.

For example, if you still owe $4,000 on your car and it gets destroyed in a wreck, the lender gets any insurance payment for the totaled vehicle before you do. If your car is actually worth less than you owe on it (say, $3,000), you won’t get a dime of the insurance money and you will still be responsible for paying off the rest of the loan ($1,000). You’ll be without a vehicle and $1,000 in debt on a car that’s likely being put in a crusher.

What Can You Do to Minimize Your Losses?

Because insurance companies are looking for ways to minimize their losses, it’s in your best interest to do a bit of legwork to make sure your insurance company isn’t missing important information that may affect the value of your vehicle. In order to put together your own estimate of what your car should be worth, follow the tips below:

- Maintain records of repairs and upgrades — If your car has gotten a major repair (new engine, rebuilt transmission, replaced head gasket(s), etc.), it can drastically affect the value of your vehicle. Even minor repairs or upgrades (new tires, better sound system, etc.) can affect the value of your car. If you keep a record of these things, you can factor those repairs and upgrades into the estimated value of your car.

- Don’t forget about your vehicle’s optional features — The insurance company may make their calculations based on the basic model of your vehicle. If your car has optional features like heated seats, a sunroof, etc., those additions should be factored in to the value of your vehicle.

- Review your vehicle’s pricing carefully — Websites like Kelley Blue Book or Edmunds can show you a range of pricing in your area for your vehicle and take into account factors like whether your car had lower mileage than average, whether it had minimal cosmetic issues, etc. All of these things matter when the value of your car is being calculated.

- Remember to take into account other costs you wouldn’t need to pay — Part of your insurer’s estimate for your car’s value should be the registration costs, title costs, and sales tax for getting a new vehicle. None of these costs would have been incurred if your car had not been totaled.

If the value you come up with is substantially different from your insurance company’s estimate, you may want to ask for a second opinion. Depending on your policy, you may have the right to get an independent appraisal (likely at your own expense) to contest the insurance company’s estimate.

Plan Ahead for a Totaled Vehicle

Of course, the best way to minimize your losses is to plan for the possibility of a total loss before it happens. In fact, CCC Information Services reports that the number of cars determined total losses has been rising steadily in recent years, especially among older vehicles. In light of this fact, it’s important to consult with your vehicle insurance provider before a crash occurs so you know what protections and rights you do and do not have.

For example, “gap insurance” is a type of available coverage that can cover the difference between the insurance company’s offer on your totaled vehicle and the balance of the loan that you still owe. In our scenario above, if that person who still owed more than the vehicle’s value had gap insurance, they would not have incurred the $1,000 in debt and could have at least started looking for a new vehicle while their accounts were in the black.

You should also find out if your insurance covers a rental car for you while your claim is being processed or for even longer as you search for a new vehicle. Because the cost of a rental car can be significant, having that expenditure covered while your total loss claim is underway can be a significant benefit that factors into your calculations.

Lastly, insurance agents are usually much more willing to be helpful and candid if a claim is not currently being processed. It’s good to talk to them about the details of your policy and discover what your rights are for challenging a settlement or appraisal long before you need to exercise these rights. If you’re not satisfied after looking closely at the terms of your policy, it may be in your best interest to shop around for new car insurance with more comprehensive coverage.

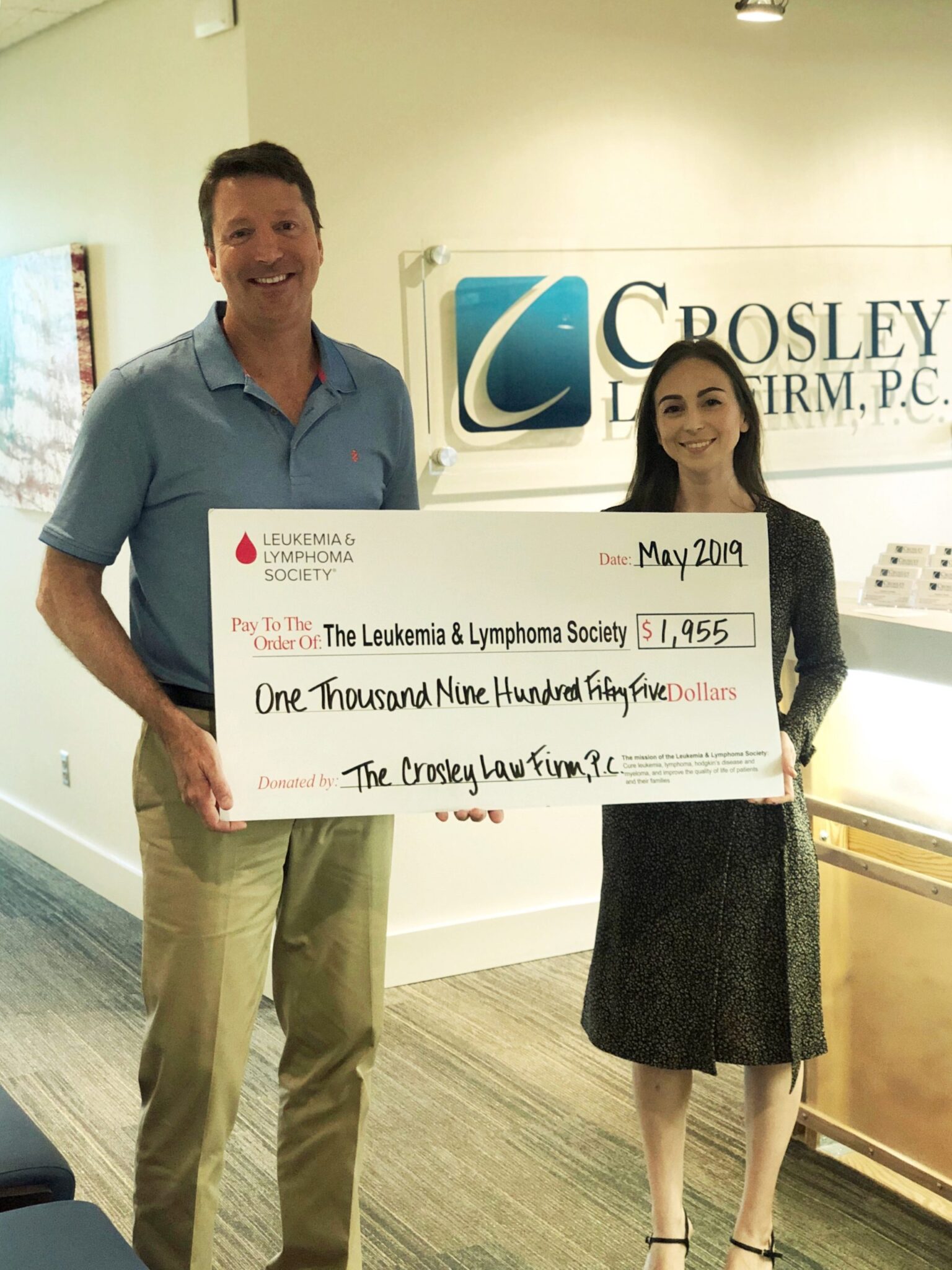

Crosley Law Firm: Advocating for Car Accident Victims

If you or someone you know has been injured in a car accident, the last thing on your mind in the moments and days after is what you’re going to do about transportation. However, in addition to a total loss settlement, the insurance company may also try to make you a settlement offer for your injuries after the car wreck. Often, these settlement offers are made before you can truly know the extent of your injuries or if you will have costs associated with long-term care as a result of them.

For these reasons and more, it’s helpful to review any offer from an insurance company with help from an attorney who is familiar with the laws and regulations in your state and who has seen many cases similar to yours. They can give you honest advice about what your best course of action is and what your options are for receiving justice and compensation for your injuries and the damage to your vehicle.

Call Crosley Law Firm today at (210) 354-4500 to schedule a free consultation with one of our experienced attorneys. You can also fill out our convenient online contact form. We know that the days, weeks, and months after a car crash can be stressful — not just emotionally, but financially as well. That’s why we offer free consultations and why we work on a contingent fee basis, which means you don’t pay us a dime unless or until we settle your claim or win your case in court. Don’t wait — get in touch with Crosley Law Firm today.

References

Gotsch, S. (2015, November 13). What’s driving total loss frequency? CCC Information Services Inc. Retrieved from http://www.cccis.com/whats-driving-total-loss-frequency/

Wickert, G. (2013, December 5). When is a vehicle considered a total loss? Claims Journal. Retrieved from http://www.claimsjournal.com/news/national/2013/12/05/240841.htm