Because ridesharing companies are a relatively new (and extremely popular) addition to the market, many unexpected questions have arisen about their operation: should these companies be regulated in the same way as taxi companies? Is it even fair to regulate ridesharing services in the same way as taxi companies? Should the city require rideshare drivers to have the same qualifications as taxi drivers? Will consumers have sufficient insurance coverage while using a rideshare service? This list of questions and concerns seems to only be getting longer, which is perhaps why San Antonio’s Public Safety Committee recently postponed making a decision about allowing Lyft and Uber to operate in the city until November.

Amongst all the controversy, a few things are clear. First of all, it is currently illegal for Lyft and Uber to be operating in the city of San Antonio. In fact, police have been ticketing Lyft and Uber drivers as well as towing and impounding their vehicles. However, it appears as though these services are still active in the city.

It’s also clear that consumers have very good insurance coverage if they are taking advantage of these services (which are, just to reiterate, illegal in San Antonio). For example, both Lyft and Uber provide insurance coverage up to one million dollars (in addition to the driver’s own insurance policy) that begins the moment a passenger steps into a ridesharing vehicle. It has been widely publicized that this amount is, in fact, almost 18 times higher than the coverage amount required for taxis in San Antonio, which is a completely different issue altogether (and one that we discussed in depth in an earlier post).

Although the insurance coverage involving paying customers is very transparent, the biggest and most controversial questions about ridesharing companies involve insurance coverage for the drivers when they’re off duty or when they’re driving to or from a job. There have been numerous cases recently where drivers have gotten involved in a crash while driving around waiting for a new fare or while driving home from a fare. Earlier this year, for example, an Uber driver struck a family in a crosswalk causing severe injuries to the mother and 4-year-old son while fatally injuring her 6-year-old daughter. At the time, it appears as though he did not have an active fare; however, the driver claimed that he was only in the city because he was hoping to get a few rides.[2]

This is exactly where some of the gray areas involved with ridesharing insurance coverage arise. As NPR has reported, “Uber uses social media to match drivers and passengers. The company also asks drivers to hang out on the streets — especially during peak times like New Year’s Eve — so they can respond to new requests quickly. Drivers even get rated by their response time.”[2] Despite wanting drivers in opportune locations at peak times, Uber and Lyft, unlike taxi companies, do not provide any coverage unless a driver has an active fare.

Uber and Lyft also do not provide any coverage for drivers returning from a job, so if a driver’s only purpose for being on the road is to complete a fare, they do not receive coverage for their entire trip. Thus, if they get in an accident, even though it was essentially during a time that they were performing their job because they would not have been on the road otherwise, their personal insurance is the only one covering them, much to the chagrin of their insurance company.

The blurred line between what counts as personal and professional driving as well as the use of what basically amounts to conditional commercial insurance policies leaves drivers stuck in the middle of insurer/company/insurer battles: The driver’s insurance doesn’t want to pay claims that directly result from commercial (and thus riskier) activities, ridesharing companies don’t want to pay for full commercial insurance to cover their drivers at all times, and the ridesharing service’s insurers don’t want to pay claims for drivers that aren’t actually “on the job.”

But it’s not just ridesharing drivers who are going to suffer from this coverage problem. Down the road, the aggregate effect of increased “off duty” claims being made and paid by drivers’ insurance companies will mean higher premiums for all drivers, especially if the popularity and use of these ridesharing services continues to grow.

Ultimately, a future with ridesharing as a potential or even primary form of transportation is uncertain. Obviously, the issues related to driver coverage need to be clarified to keep our roads as safe as possible. In the meantime, we can only wait and see what decision City Council will make based on the information they gather between now and November. We should also do our best to stay informed about this issue and use our best judgment as we make decisions about our transportation needs.

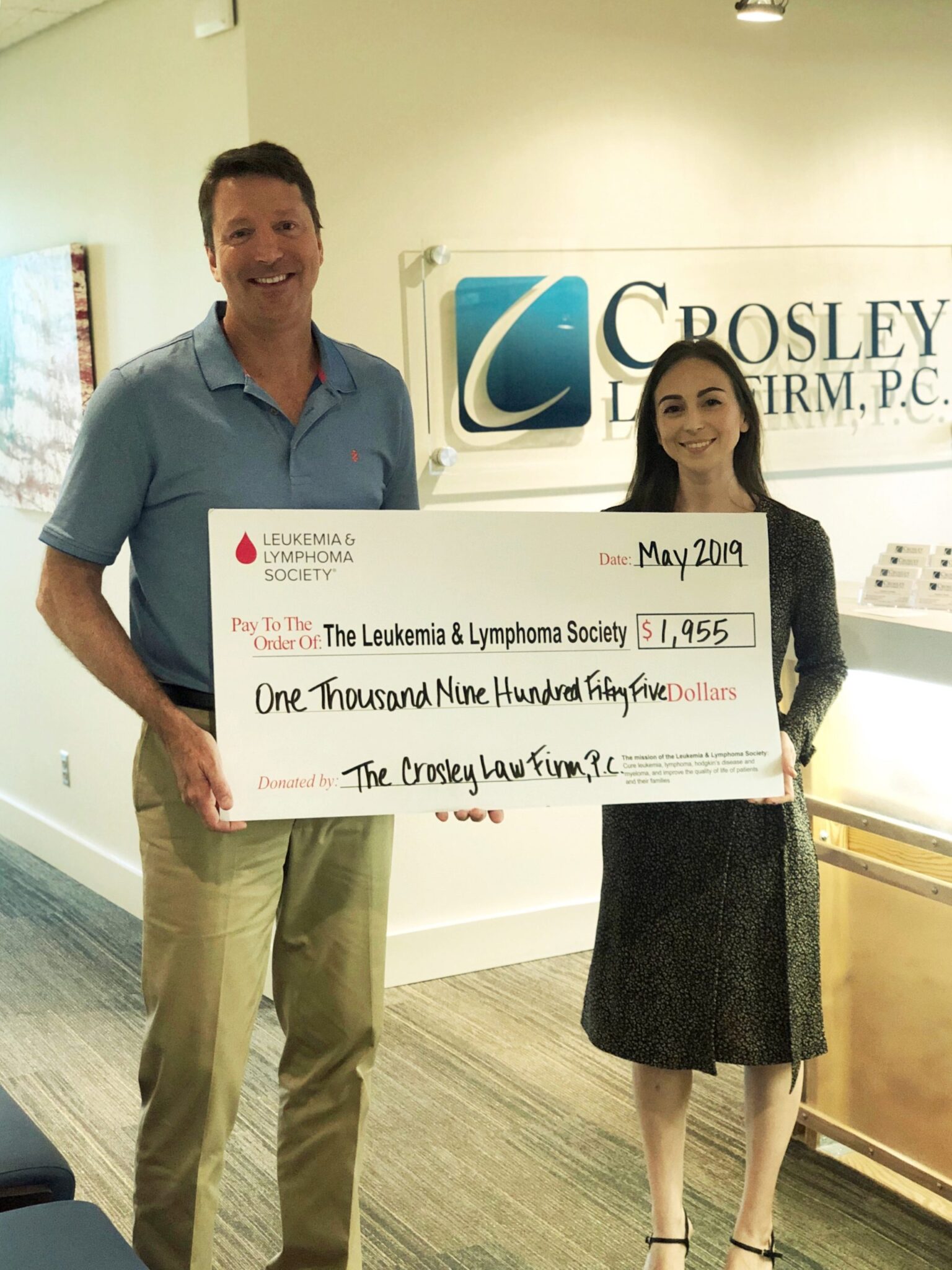

Should you be involved in a car accident of any kind, contact Crosley Law Firm right away. We stay up to date on all of the most recent news, regulations, and laws, and our attorneys have years of experience dealing with auto accident claims in Texas. You can reach us by phone at (877) 535-4529 or you can submit your information on our website for an absolutely free case review.

References:

[1] Saldaña, R. (2014, September 1). Embrace Uber and Lyft to signal SA is for millenial. mySA: San Antonio’s Home Page. Retrieved from http://m.mysanantonio.com/opinion/commentary/article/Embrace-Uber-and-Lyft-to-signal-SA-is-for-5726705.php

[2] Shahani, A. (2014, February 2). Should Uber be responsible for driver recklessness? NPR: All Tech Considered. Retrieved from http://www.npr.org/blogs/alltechconsidered/2014/02/02/270359642/is-uber-responible-for-driver-recklessness