Insurance companies often try to deny claims and save money. While some accident claims involve legitimate disputes, insurance companies sometimes abuse their power and deny valid claims. In these situations, you might have an insurance bad faith claim. Below, Crosley Law Firm explains how to identify insurance bad faith and what you can do about it.

What Is Insurance Bad Faith?

Under Texas law, your insurance company has a duty to handle your claims in good faith. The law recognizes that the insurance company holds extraordinary power when you file a claim. They have employees with much more experience, knowledge, and decision-making power than the typical person. This means that the company can easily manipulate accident victims, denying and delaying legitimate claims to save money and increase profits.

To prevent abuse, Texas imposes an “implied covenant of good faith and fair dealing” on insurance companies. When you file a claim with your own insurance company, the company must treat you honestly and fairly. They should not deny or delay your benefits without a good reason. When your insurance company violates this duty, you might have an insurance bad faith claim.

“Insurance companies do not have to act in good faith in third party claims, when you file a claim with someone else’s insurance policy.”

While bad faith claims can arise out of any first party insurance claim (when you file a claim against your own policy), they are most common in personal injury protection (PIP), uninsured/underinsured motorist (UM), and property damage claims. Insurance companies do not have to act in good faith in third party claims, when you file a claim with someone else’s insurance policy.

An insurance bad faith claim is different than a personal injury claim. In a personal injury lawsuit, you seek compensation for damages you suffered because of an injury caused by someone else. These might include lost income, pain and suffering, and the cost of your medical treatment. In an insurance bad faith claim, you are demanding compensation from your own insurance company for the harm you suffered due to the insurance company’s misconduct.

When your insurance company acts in bad faith, Texas law allows you to recover:

- Up to three times what you would have received if the insurance company had handled your claim in good faith (if there was intentional violation)

- Attorney fees

- Court costs

- Interest

- Pain and suffering, under certain circumstances

- Punitive damages, if the insurance company’s behavior was bad enough

Every insurance bad faith claim is unique and fact-specific. If you have questions about the value of your insurance bad faith claim, it’s in your best interest to consult with a San Antonio lawyer.

Examples of Bad Faith Practices

Some common bad faith practices include:

- Denying your claim without giving you a sufficient reason

- Failing to perform a thorough investigation of your claim

- Unfairly delaying a claim investigation

- Not issuing payments within a reasonable time period

- Offering an unfairly low settlement offer and refusing to negotiate

- Denying a valid insurance claim

- Threatening or intimidating an accident victim

- Willfully misstating the law or your policy terms

- Refusing to provide you with information or documents concerning your claim

However, a bad faith insurance claim involves a very detailed and fact-based analysis. It can be difficult to identify bad faith without the help of an experienced insurance lawyer. What might seem like honest delays and miscommunication might actually be something much more malicious.

RELATED VIDEO: Should I Accept the Insurance Company’s Settlement?

What Should I Do if I Think There’s Insurance Bad Faith?

When you file an accident claim, it’s always in your best interest to keep good records. This includes collecting:

- Copies of every form, letter, and document you send the insurance company

- Every letter and notice the insurance company sends you

- Detailed notes about when you speak with the insurance adjuster or other representatives, including the date, time, and subject matter involved

You can also request a complete copy of your claim file (although you might have to pay copying fees for this information).

RELATED VIDEO: Do You Need an Attorney for Every Case?

If the insurance company is unreasonably delaying your claim, making you wait excessively long times for benefit payments, or engaging in other suspicious behavior, you should immediately consult with a San Antonio insurance claims lawyer.

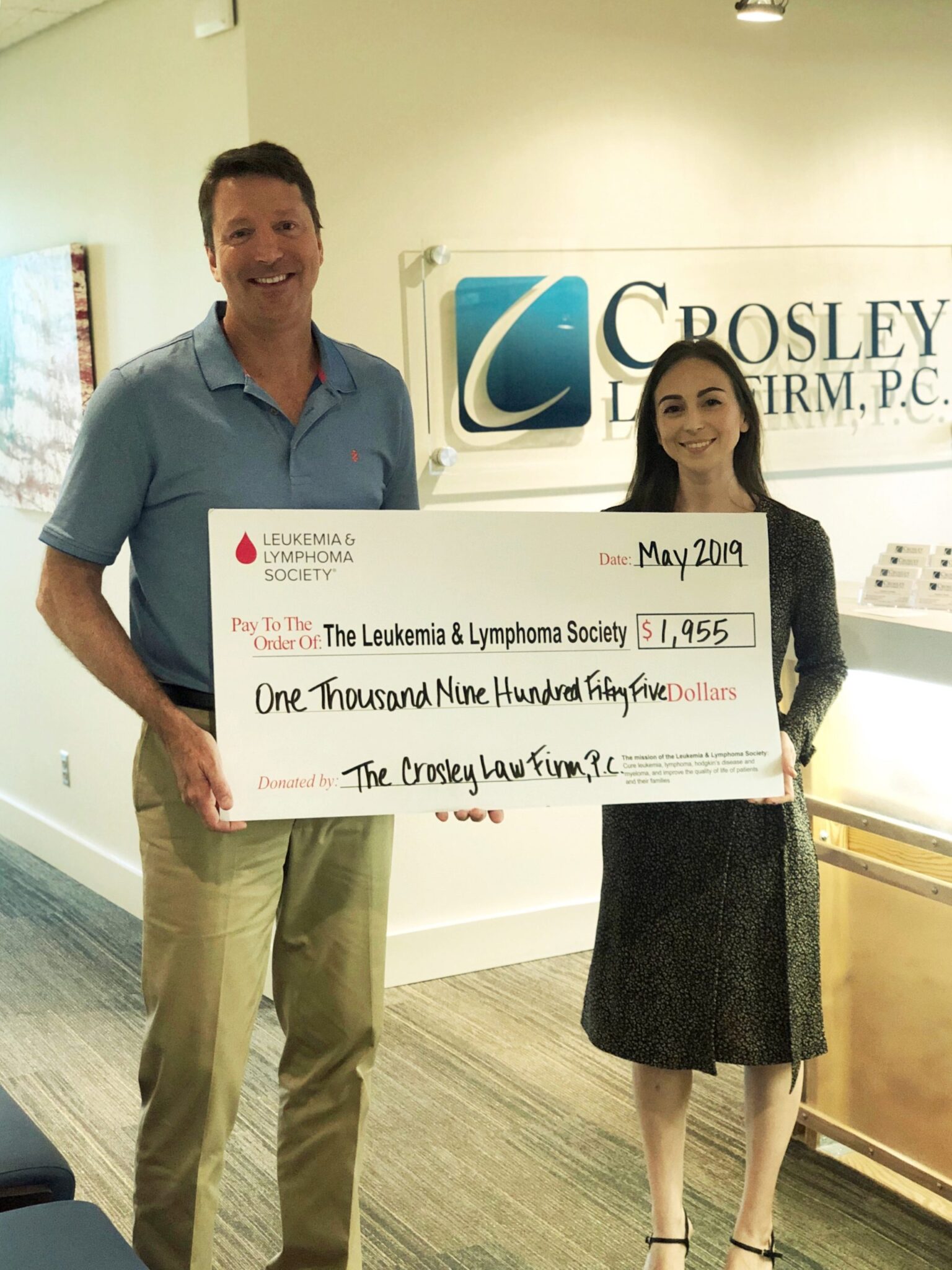

Crosley Law Firm: Fighting on Behalf of Accident Victims in San Antonio and Throughout Texas

Too frequently, accident victims fail to identify their insurance bad faith claims and lose valuable compensation. While delays and disagreements are often part of dealing with your insurance company, don’t assume that they are treating you fairly. It’s in their best financial interest to give you the runaround.

At Crosley Law Firm, we help our clients with a wide variety of insurance-related claims, including insurance bad faith issues. If you think the insurance company isn’t dealing with you fairly, request a free consultation by completing our online form or calling 210-LAW-3000 | 210-529-3000.

The content provided here is for informational purposes only and should not be construed as legal advice on any subject.