Unlike many other states, Texas does not require most private employers to provide workers’ compensation insurance. There are a few exceptions, such as public employees, building and construction contractors who work for public employers, motor bus companies, and some others. Outside of these cases, employers are not mandated to carry coverage for their workers.

In general, many large employers do tend to carry coverage, but smaller employers may not have the funding to do so. Overall, an estimated 81 percent of the Texas workforce is covered under the worker’s compensation system.[1]

Significant changes to workers’ compensation in Texas occurred with the passing of House Bill 7 in 2005, which was designed to reform the administration structure of the workers’ compensation system in the state and make changes to the way benefits are provided to injured workers. H.B. 7 created new departments and oversight, which marked a significant change from the former Worker’s Compensation Commission that was comprised of only six members. This bill also established the Office of Injured Employee Counsel (OIEC) to represent workers and provide assistance in administrative disputes.

If an employer chooses to provide workers’ compensation insurance, then the insurance will cover usually cover a percentage of lost wages and all medical benefits for employees who are injured on the job. The main benefit to employers is that, if they have workers’ compensation insurance in place, then an injured employee’s exclusive remedy for on the job injuries is through the workers’ compensation system. In other words, an injured employee is barred from suing his or her employer for an on the job injury if the employer has worker’s comp. There are some exceptions, however. If the employee is killed while on the job, then a lawsuit for punitive damages against the employer may be filed in the court system. The employee’s family will have to prove that the injury was caused by gross negligence, and certain other limitations apply. Another exception involves employees who are injured by the conduct of someone other than their employer. Examples include injuries to an employee that are caused by a subcontractor on a job site, or by a defective piece of equipment manufactured by someone other than the employer.

Nonsubscribers (employers who choose not to have workers’ compensation insurance), on the other hand, leave themselves open to personal injury lawsuits from employees who suffer an injury on the job. If an employer decides not to provide coverage, they must do the following things:

- File an annual notice with TDI

- Display notices of noncoverage throughout the workplace

- Provide a written statement of noncoverage to each new employee

Ultimately, employers who choose not to provide worker’s compensation insurance can be responsible for paying punitive damages if they lose a lawsuit. According to the Texas Labor Code, certain common-law defenses are also voided by refusing to offer coverage; for example, employers cannot claim that the injured employee’s negligence caused the injury, that the negligence of fellow employees caused the injury, or that the injured employee knew about the danger and voluntarily accepted it.

However, many nonsubscribers do purchase a private policy of insurance to cover employee injuries. These benefits are usually part of an employee injury benefit plan. If you are an employee covered under that type of plan, it is important to carefully read and understand the plans’ rules about reporting an injury as well as requesting and obtaining benefits in the case that you do suffer an injury as a result of your job. If you don’t have a copy of the injury benefit plan, request one from your employer as soon as you can.

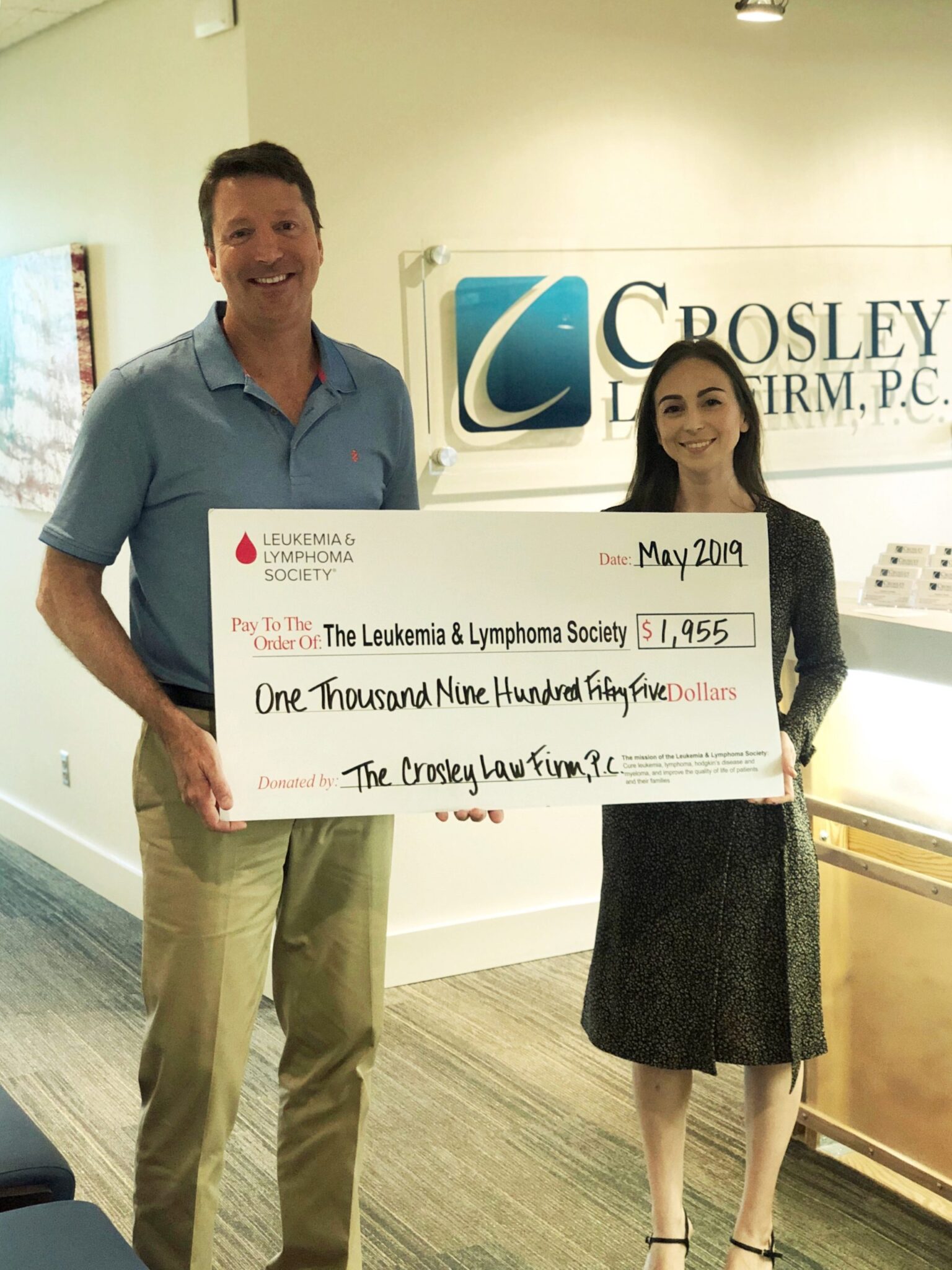

If you’ve been injured on the job and are unsure about whether or not your employer is a nonsubscriber or if you have questions about your rights following an on-the-job injury or your employer’s injury benefit plan, contact Crosley Law Firm for a free consultation.

[1] Root, J. (2014, June 28). Best insurance for Texas workers? “Don’t get injured.” The New York Times. Retrieved from http://www.nytimes.com/2014/06/29/us/the-state-has-a-record-of-high-worker-fatalities-and-of-weak-benefits.html?_r=0