Nearly 40% of all auto accidents occur at intersections, and most of those crashes involve left turns. Margie’s accident was no different — it resembled so many others that occur every day here in San Antonio, especially along busy four-lane city roads.

Crashes like these can seem routine, but it’s important to remember that each one involves a human being, now suffering for someone else’s mistake. In this case, the victim Margie was a young mother with three children, and her “routine” accident left her in serious pain, with thousands in medical bills and an evasive insurance company that wouldn’t return her calls.

Margie knew she was in the right, and she wasn’t going to go down without a fight. But she needed help.

An Inattentive Driver Takes a Bad Turn

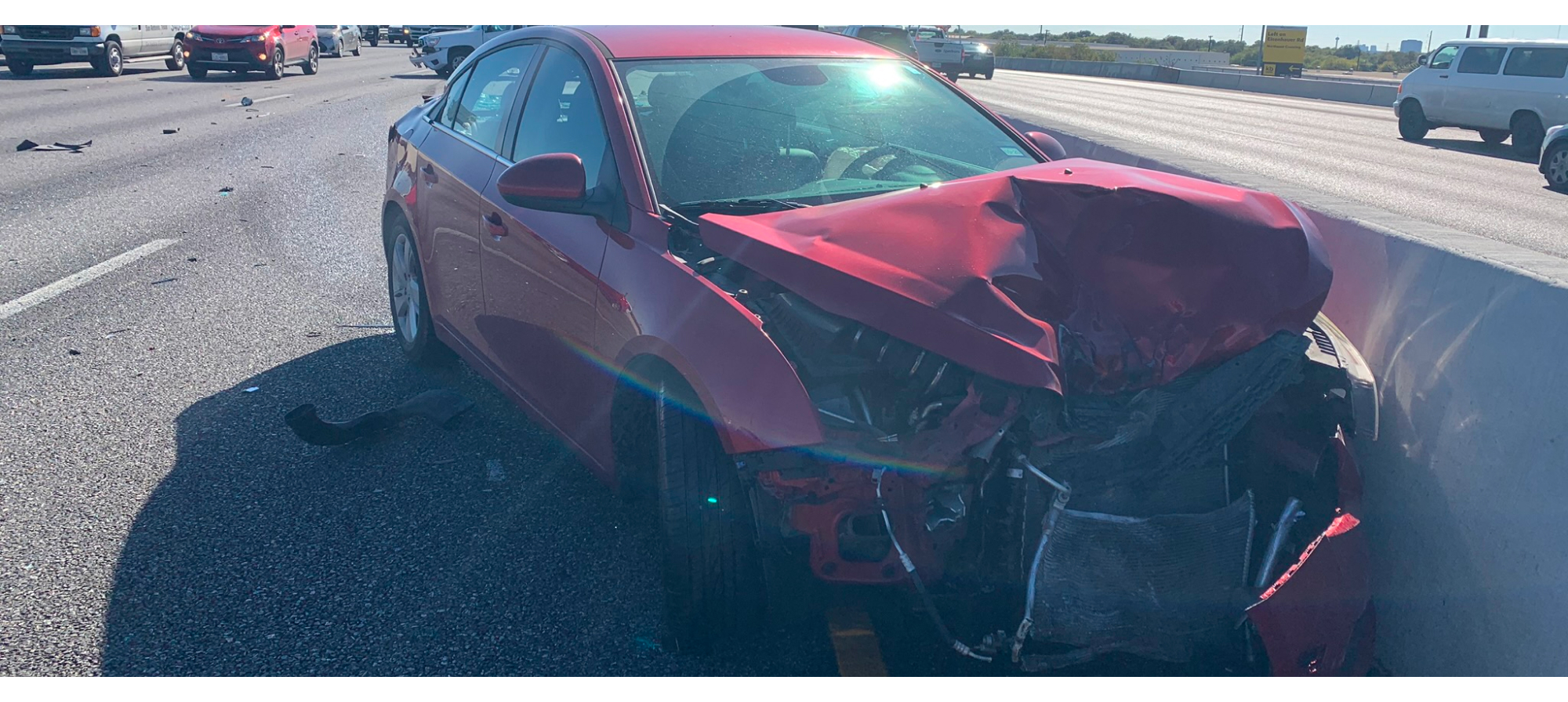

Margie was driving southbound down South Flores Street, approaching a signaled intersection. The light was green, she had the right of way, and she was traveling at a safe rate of speed.

But just before Margie reached the intersection, another car heading north made a left turn directly into her path. There was no time or space to react, and the other car slammed into the front driver’s side of Margie’s Chevy.

Margie Develops Chronic Neck and Back Pain

After the accident, Margie drove herself to the emergency room. She was suffering from burns on her arms because of the airbags deploying, and she also had stomach pain and soreness from her seatbelt. The doctors checked her out and released her the next evening.

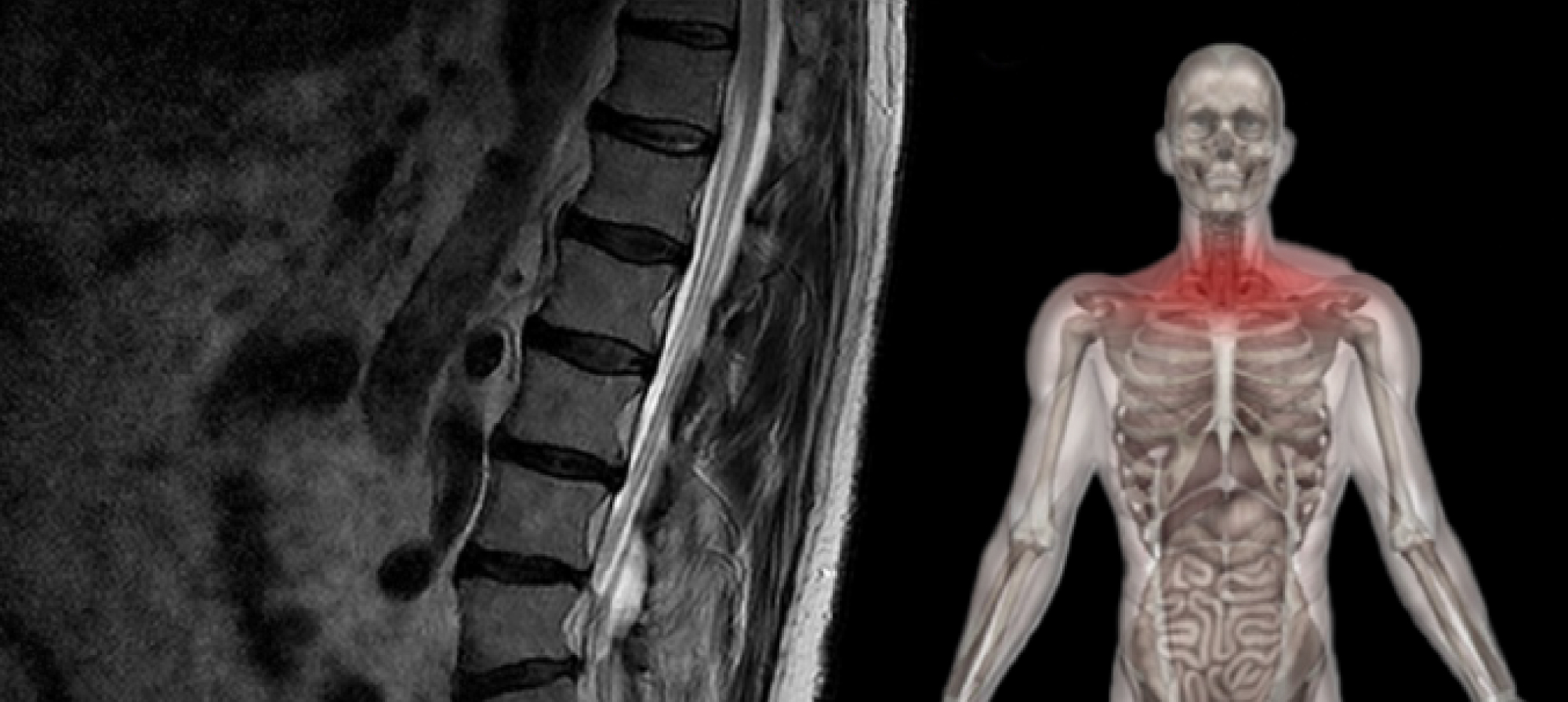

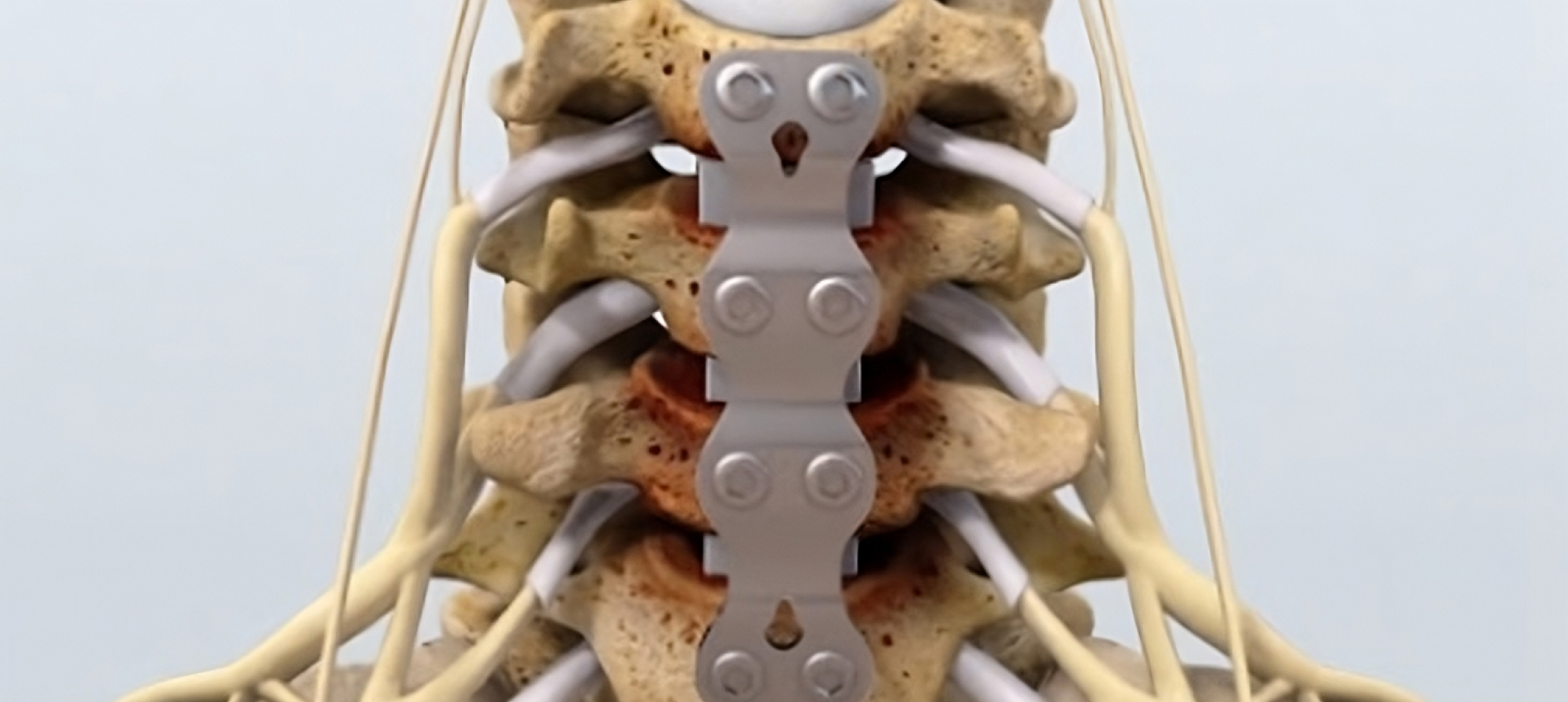

However, the following morning, Margie couldn’t move her neck. Later medical evaluation and imaging would reveal damage to three separate cervical discs in her neck. This was in addition to post-traumatic headaches, muscle spasms, and chronic pain in her upper back, neck, and forearm.

Worse, the other driver’s insurance company had no interest in helping Margie get back on her feet, even though their driver was clearly at fault.

“It was one of those smaller insurance companies where they really gave me a hassle,” said Margie. “They wouldn’t talk to me — gave me the runaround.”

Margie’s life had turned upside down. With three kids, no car, significant mobility issues, pain, and an insurance company that refused to do the right thing, she needed help.

The Insurance Company Pays Up After Crosley Law Refuses to Quit

Margie began searching online for an experienced, tenacious personal injury law firm that would take her case. After reading the online reviews for Crosley Law, she decided to go with her gut and reach out.

We answered her call on a Sunday morning, and within a few days, we were able to help her get the medical care she needed. Meanwhile, we began working on her case, which meant dealing with the unreasonable insurance company.

The other driver, an older man, tried to shift some of the blame from his shoulders by stating that he lost control of his legs just before the crash. While this claim was dubious and not supported by evidence, the man’s insurance company initially refused to accept more than 80% liability for the accident.

Since the at-fault driver was only carrying the Texas state minimum of $30,000 in liability coverage, 80% coverage would still leave Margie on the hook financially for a significant portion of her medical bills. We knew this treatment wasn’t right or fair, so our attorneys refused to accept it.

Fortunately, the facts were overwhelmingly on our side. Within about a month, the insurance carrier relented, accepted full liability, and agreed to offer the full limits of the policy—without us needing to file a lawsuit.

But that’s not the end of the story.

Crosley Law Negotiates to Settle Margie’s Medical Bills

As noted above, the at-fault driver was only carrying $30,000 in liability coverage on his insurance policy. Unfortunately, Margie was not carrying any personal injury protection (PIP) or underinsured motorist (UIM) coverage of her own, meaning $30,000 was the maximum amount that could be obtained. Considering her medical bills already totaled over $44,000, this left Margie in a tough situation.

Unfortunately, it’s a problem we see all the time and a big reason why we always encourage drivers to purchase as much PIP and UM/UIM as they can comfortably afford. You never know when you’ll be in a serious accident with an uninsured or underinsured driver. If the driver who caused Margie’s accident had been uninsured, then Margie would have had no case.

Crosley Law deals with this kind of situation frequently, and we weren’t about to leave Margie on the hook just because her claim with the insurance company had been settled. After our business with the insurance company was concluded, we set to work negotiating with Margie’s healthcare providers.

Ultimately, we were able to reduce Margie’s debt by more than 78%, from nearly $45,000 to less than $10,000. That was enough for her to pay her bills and still have a little left over for her family. Margie said she was thrilled with the outcome.

“Despite being in the middle of COVID, [Crosley Law] was able to settle my case in eight months,” she said in a recent 5-star review. “I was very impressed with the overall experience! If you are looking for a law firm that makes you feel like you are important and fights for you, please call them!”

Crosley Law: San Antonio’s Trusted Car Accident Lawyers

Whether you were involved in a catastrophic truck accident or a “routine” fender bender that resulted in not-so-routine injuries and medical bills, you deserve an experienced personal injury attorney who will fight for your rights, always make sure you’re treated well, and keep you informed about your case.

All our cases begin with a free, no-obligation consultation to discuss your case, your rights, and your legal options. To schedule your free consultation today, call 210-LAW-3000 | 210-529-3000 or use the contact form on our website. We look forward to hearing from you!